- Intended for use by lenders and other outside parties who may appreciate them business’s association with a CPA without requiring a level of assurance on the accuracy of financial statements

- Typically appropriate when initial or lower amounts of financing or credit are sought or significant collateral is in place

- CPA issues compilation report

Compilation of financial statements is a service where the role of the CPA is more apparent to outside parties, and as such, the requirements for performing this service are more explicit. For example, if the CPA is not independent from ownership, management and other circumstances in their relationship to you and your business, she is required to disclose the impairment to her independence in her compilation report. The compilation report is the first page before the actual financial statements and is written by the CPA on her firm’s letterhead.

The CPA is also required to read the financial statements in light of the financial reporting framework being used and consider whether the financial statements appear appropriate in form and are free from obvious material misstatements.

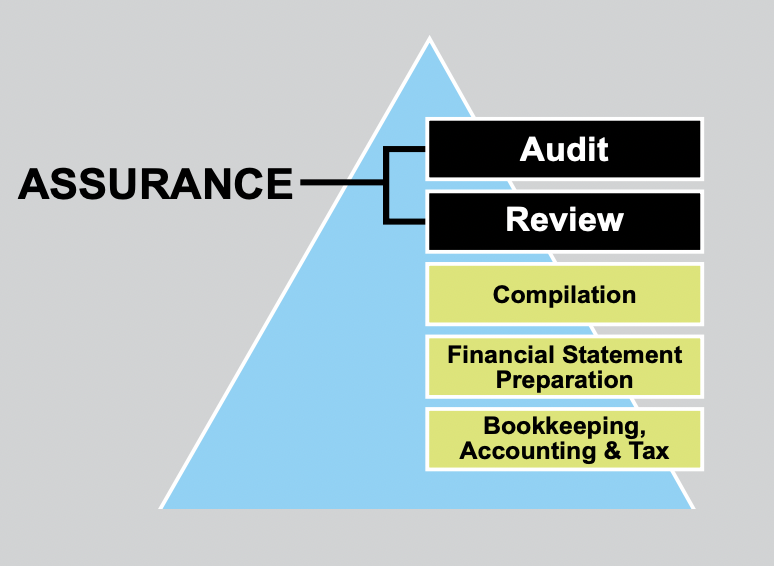

UNDERSTANDING ASSURANCE

A CPA can obtain a level of “assurance” about whether the financial statements are in accordance with the financial reporting framework. The CPA obtains assurance by obtaining evidence. There are different levels of assurance that a CPA can obtain that can range from no assurance at all, to

the highest level of assurance, which is an audit. The level of assurance required by lenders is typically based on the size of the loan, the collateral, and their determination of the overall risk.

Other situations that often require a level of CPA assurance include performance bonding and leasing. Certain trade creditors, outside investors, or family owners that are not actively involved in the business may also request or require a level of assurance on your financial statements. If your requirements are unclear, in many cases, your CPA can speak with your lender and others about the level of service that will satisfy their requirements

UNDERSTANDING A MISSTATEMENT AND MATERIAL MISSTATEMENT

A misstatement is a difference between a reported financial statement item and that which is required for the item to be reported in accordance with the applicable financial reporting framework. A misstatement may result from fraud or error. A material misstatement is one where the severity or nature of the difference (i.e., misstatement) would cause a user to form an incorrect conclusion about a financial statement.